Internet Technology

Build Your Web&Store Easily with Simple Tools for E-commerce

Starting your web&store doesn’t have to feel overwhelming. The e-commerce landscape is dynamic, but one core truth remains consistent: simplicity wins. Whether you’re launching your first store or improving an existing one, using the right tools can significantly streamline the process. This guide will explore simple yet powerful tools to help you build a professional website and store while effectively scaling your e-commerce business.

Why Choose Simple Tools for E-commerce?

The e-commerce industry is growing, and accessibility has never been better. But there’s a catch. With so many platforms and solutions out there, deciding what to use can feel daunting.

Simple tools eliminate unnecessary complexity, allowing you to focus on what matters most—running your business. Using these tools not only saves time and effort but also ensures a seamless experience for both you and your customers.

Some benefits include:

- Ease of Use: You don’t have to be a web developer or designer to create a functional and attractive online store.

- Efficiency: Automate repetitive tasks, giving you more time to concentrate on growth.

- Scalability: Tools designed for simplicity often grow with your business needs.

Now, let’s explore the essentials you’ll need to get started—with ease.

Building Your E-commerce Website- web&store

Your website serves as the foundation of your online presence, and it’s where customers experience your brand firsthand. Creating an easy-to-navigate and visually appealing site is crucial.

1. Choose a Beginner-Friendly Website Builder

Platforms like Shopify, Wix, and Squarespace are perfect for beginners. Here’s what makes them ideal choices:

- Drag-and-Drop Editor: No coding required. Simply drag elements like text, images, and product boxes to customize your store.

- Pre-Made Templates: Professionally designed templates make your store look polished and on-brand.

- Integrated Features: Get built-in tools for blogging, SEO, and analytics.

Pro Tip

Select a platform that offers mobile-friendly designs. With mobile shopping on the rise, a responsive site is non-negotiable.

2. Domain and Hosting Made Simple

Platforms like Shopify and Wix provide one-stop solutions for domain names and hosting.

- Domain Name: Aim for something short, memorable, and clearly tied to your brand.

- Web Hosting: Ensure fast loading times and secure hosting through reliable providers. Hands-off hosting means you can focus on selling, not troubleshooting.

3. Customize Your Website with Branding Tools

Consistency in branding builds trust. Tools like Canva simplify creating visuals like banners or product images without needing graphic design skills.

Key elements you’ll want on your site:

- Homepage that captivates visitors.

- A clean “About Us” page that tells your story.

- Intuitive navigation for seamless browsing.

Add Essential E-commerce Features Without Stress- web&store

A website alone doesn’t make a store. Here’s how to take it further.

1. Set Up a Reliable Shopping Cart

Shopping cart functionality is critical, and your customers expect secure, problem-free purchases. Use tools like Shopify Payments or PayPal Checkout for seamless transactions.

2. Leverage Simple Inventory Management Tools

Managing inventory manually can be a headache. Tools like Square or Zoho Inventory integrate easily with beginner-friendly platforms and help you track stock effortlessly.

3. Enable Multiple Payment Options

Most platforms offer built-in payment solutions, but ensure they accept popular methods like credit cards, PayPal, and even Apple Pay or Google Wallet. The easier payments are, the higher your conversion rates.

4. Add Shipping Features

Use tools like ShipStation for automated shipping rates, labels, and order tracking. Clear communication on delivery times builds trust and boosts customer satisfaction.

Drive Sales with Simple Marketing Tools- web&store

Once your web and store are set up, focus on attracting and retaining customers.

1. Email Marketing

Stay connected with your customers through platforms like Mailchimp or Klaviyo. These tools make it incredibly easy to create and automate email workflows for:

- Welcome emails when someone joins your mailing list.

- Abandoned cart reminders to recover lost sales.

- Exclusive promotions and product launches.

2. Social Media Integration

Social platforms like Instagram and Facebook are powerful for e-commerce. Use tools such as Later or Hootsuite to schedule posts and manage your accounts seamlessly.

Don’t forget to enable direct shopping links, allowing customers to make purchases straight from your social profiles.

3. SEO Simplified

Many platforms like Wix and Squarespace come equipped with built-in SEO tools, helping your products appear in search engine results. Focus on optimizing:

- Page Titles and Descriptions

- Product Listings with Keywords

- Alt Text for Images

Create a Seamless User Experience

Your customers deserve a frictionless online shopping experience. Avoid overwhelming them with clutter or unnecessary steps.

Optimize for Speed

Slow websites cost sales. Test your site’s speed using tools like Google PageSpeed Insights, and optimize whenever necessary.

Test Everything

Run usability tests with friends or potential customers. Ensure pages load correctly, all links work, and the checkout process is smooth.

Simplify the Checkout Process

Fewer clicks mean higher conversions. Platforms like Shopify enable single-page checkouts, which have been shown to decrease cart abandonment rates.

Foster Community Among Your Shoppers

Building an online store isn’t just about selling products. It’s about creating a loyal customer base.

- Create an email newsletter featuring stories, promotions, and tips related to your products.

- Use review tools like Yotpo or Trustpilot to showcase glowing customer feedback.

- Host giveaways or collaborate with influencers to grow your brand’s presence.

Final Thoughts- web&store

Creating an e-commerce store doesn’t require technical expertise or a hefty budget. Using simple, effective tools can empower you to build a professional website, provide exceptional customer experiences, and develop lasting connections with your audience.

Start small, stay consistent, and watch your store grow. If you’re ready to take the next step, explore platforms like Shopify or Wix that truly simplify the entire process of building and managing your online store.

FAQs- web&store

1. How do I choose the right e-commerce platform?

Selecting the right e-commerce platform depends on your needs and budget. Look for platforms that offer user-friendly interfaces, essential features like payment integration, and customization options. Popular choices include Shopify, Wix, and BigCommerce.

2. What payment methods should I offer to customers?

To cater to a wider audience, provide multiple payment options such as credit cards, PayPal, Apple Pay, and digital wallets. Ensuring secure payment gateways builds trust with shoppers and increases conversion rates.

3. How can I improve my website’s loading speed?

Faster loading speeds improve user experience and SEO rankings. Optimize images, use caching tools, and choose reliable hosting. Many e-commerce platforms offer built-in performance optimizations to assist you.

4. How do I drive traffic to my online store?

You can drive traffic using a mix of strategies like SEO, paid ads, content marketing, and social media campaigns. Engaging with your audience and offering promotions can also attract visitors.

5. Is it necessary to have a mobile-friendly website?

Yes, a majority of customers shop via mobile devices. Ensure your website is responsive and provides a seamless shopping experience across all screen sizes. Most modern e-commerce platforms automatically optimize for mobile.

6. How do I handle shipping and returns?

Set clear policies for shipping and returns to give customers confidence. Partner with reliable shipping providers and offer tracking options. Simplify the return process to keep customers satisfied and encourage repeat business.

Internet Technology

Bloomberg Internship: Your Gateway to a Thriving Career

Starting your professional journey with a can be a game-changing decision. Bloomberg, a global leader in financial data, software, and media, offers one of the most prestigious internship programs for students and recent graduates. This opportunity combines real-world experience, professional growth, and exposure to a fast-paced, innovative environment.

Whether you aspire to work in finance, data analytics, journalism, or software development, a provides the foundation to launch a successful career.

Why Choose a Bloomberg Internship?

The program stands out for its comprehensive structure, competitive compensation, and impactful work. Interns are not limited to shadowing full-time employees — they actively contribute to meaningful projects that affect Bloomberg’s global operations.

A Culture of Innovation and Inclusion

One of the most impressive aspects of a is the company’s culture. Bloomberg values diversity, equity, and inclusion. Interns are welcomed into a workplace that encourages ideas, supports learning, and rewards initiative.

Bloomberg also emphasizes community involvement and sustainability, giving interns the opportunity to participate in social impact projects and green initiatives.

Types of Bloomberg Internships Available

Bloomberg offers a variety of internship opportunities across different departments. Below are some of the most sought-after internship tracks:

. Bloomberg Software Engineering Internship

If you’re a computer science or engineering student, the can be your entry point into the tech world. Interns work on cutting-edge applications, improve existing platforms, and collaborate with teams using the latest programming tools.

. Bloomberg Data Internship

A Bloomberg data internship is ideal for those interested in data analysis, economics, or finance. Interns collect, clean, and analyze large sets of financial data that help power Bloomberg’s products.

. Bloomberg Finance Internship

This internship is perfect for those pursuing a career in investment banking, asset management, or corporate finance. Interns get hands-on experience with market analysis, trading operations, and financial modeling.

. Bloomberg News Internship

For journalism and media enthusiasts, the provides a platform to write, report, and broadcast global financial news. Interns are trained to follow journalistic integrity and understand financial markets deeply.

Eligibility Criteria for a Bloomberg Internship

To apply for a , candidates must meet the following criteria:

-

Be enrolled in an accredited university program (undergraduate or graduate).

-

Maintain a strong academic record.

-

Demonstrate leadership, teamwork, and communication skills.

-

Possess relevant skills depending on the internship (e.g., programming for tech roles, writing for media roles).

International students are also encouraged to apply, as Bloomberg supports global talent and offers internships in several countries, including the U.S., UK, India, Singapore, and Germany.

How to Apply for a Bloomberg Internship

Applying for a involves several steps. It is important to prepare thoroughly to increase your chances of selection.

. Research the Right Role

Before applying, explore the internship roles that align with your academic background and career interests. Visit Bloomberg’s careers page to learn about job descriptions, qualifications, and application deadlines.

. Prepare Your Resume and Cover Letter

Your resume should highlight relevant coursework, technical skills, and any projects or extracurricular activities. A tailored cover letter should express your passion for the role and your understanding of Bloomberg’s mission.

. Complete the Online Application

Submit your application through Bloomberg’s official career portal. Some roles might also be available via university recruiting platforms like Handshake or LinkedIn.

. Ace the Interviews

If shortlisted, you may undergo several interviews, including technical assessments, behavioral interviews, and case studies. Bloomberg often focuses on problem-solving skills, critical thinking, and cultural fit.

What to Expect During a Bloomberg Internship

A typically lasts 10–12 weeks during the summer, although some opportunities may be available year-round. Interns receive training, mentorship, and performance evaluations throughout the program.

Real Projects and Impact

Interns are placed on real projects that matter. Whether you’re building financial models or developing software applications, your work will directly influence Bloomberg’s products and services.

Mentorship and Networking

Interns are assigned mentors who guide them throughout the program. Bloomberg also hosts various networking events, speaker sessions, and team-building activities to help interns build lasting professional connections.

Bloomberg Internship Locations

Bloomberg’s internships are available in multiple global offices. Here are some of the major locations:

-

New York City (Headquarters)

-

London

-

Hong Kong

-

Singapore

-

Mumbai

-

Tokyo

Each location offers unique experiences and opportunities based on regional business operations and client demands.

Benefits of a Bloomberg Internship

Choosing a Bloomberg internship comes with a wide range of benefits:

-

Competitive Stipend:

-

Bloomberg offers one of the highest-paying internship programs in the industry.

-

Professional Development:

-

Interns receive training in Bloomberg Terminal, industry trends, and role-specific tools.

-

Full-Time Job Opportunities:

-

Many interns receive return offers for full-time roles, making it a great stepping stone.

-

Work-Life Balance:

-

Despite its fast-paced environment, Bloomberg promotes wellness and offers recreational activities to its interns.

Tips to Make the Most of Your Bloomberg Internship

To maximize the value of your , keep the following in mind:

-

Be proactive:

-

Volunteer for new tasks and showcase your initiative.

-

Ask questions:

-

Clarify your doubts and learn from your peers and mentors.

-

Seek feedback:

-

Use feedback constructively to improve your performance.

-

Network:

-

Connect with professionals across departments to expand your knowledge and opportunities.

-

Document your experience:

-

Keep track of your achievements and learnings for future reference.

Conclusion

A is more than just a summer job — it’s a career catalyst. It opens doors to future employment, enhances your skill set, and immerses you in a global professional culture. Whether your passion lies in finance, tech, media, or data, Bloomberg provides the ideal platform to begin your journey.

By preparing thoroughly and embracing the opportunity, you can make your a transformative experience that shapes your professional future

Internet Technology

Bloomberg LEI: Everything You Need to Know About Legal Entity Identifiers

In today’s global financial landscape, transparency, security, and identification are more critical than ever. One tool that plays a significant role in ensuring these aspects is the —a Legal Entity Identifier issued through Bloomberg’s recognized framework. This article dives into the depths of what a Bloomberg LEI is, its importance, how it is obtained, and why businesses worldwide rely on it for operational and regulatory efficiency.

What is Bloomberg LEI?

refers to the Legal Entity Identifier issued by Bloomberg Finance L.P., an accredited Local Operating Unit (LOU) under the Global Legal Entity Identifier Foundation (GLEIF). The LEI is a 20-character alphanumeric code that uniquely identifies legal entities participating in financial transactions. Its goal is to improve transparency in financial data systems and help manage risk in financial markets.

Introduced in the aftermath of the 2008 financial crisis, the LEI system is now widely recognized by regulators, financial institutions, and corporations as an essential identification mechanism. Bloomberg, known globally for its data integrity and financial analytics, provides a reliable platform for entities to register and maintain their LEIs.

Importance of Bloomberg LEI in Financial Markets

Theplays a pivotal role in fulfilling international regulatory requirements. It helps regulatory bodies trace the parties involved in financial transactions, enhancing trust and reducing the chances of fraud. Here’s why the Bloomberg LEI is so important:

-

Standardized Identification:

-

It provides a universal method for identifying legal entities.

-

Regulatory Compliance:

-

Required by numerous regulations such as MiFID II, EMIR, and Dodd-Frank.

-

Operational Efficiency:

-

Reduces duplication, enhances accuracy, and streamlines reporting processes.

How to Obtain a Bloomberg LEI

Getting a is a simple process that involves submitting accurate entity data through Bloomberg’s LEI registration portal. Here is a step-by-step breakdown:

-

Create a Bloomberg Account:

-

The applicant must first have a Bloomberg Terminal or register through the Bloomberg LEI website.

-

Submit Application:

-

Fill in entity details like legal name, address, country of formation, and business registration numbers.

-

Verification Process:

-

Bloomberg validates the information against official business registries.

-

LEI Issuance:

-

Once approved, the 20-character LEI code is issued and published in the global LEI database.

This process typically takes a few days, and the LEI must be renewed annually to remain active.

Bloomberg LEI vs Other LEI Providers

While there are multiple providers of LEIs, Bloomberg LEI is particularly popular for several reasons:

-

Global Reach:

-

Bloomberg serves clients in over 100 countries, ensuring accessibility.

-

Data Accuracy:

-

Known for its data precision, s verification processes are stringent and reliable.

-

Seamless Integration:

-

Bloomberg Terminal users benefit from direct integration and easy access to LEI data.

Compared to other Local Operating Units, LEI services offer better customer support and quicker processing times, making it a preferred choice among institutional investors.

Regulatory Framework Surrounding Bloomberg LEI

Several regulatory bodies around the world mandate the use of LEIs, including the European Securities and Markets Authority (ESMA), the U.S. Commodity Futures Trading Commission (CFTC), and others. Some key regulations that require the Bloomberg LEI include:

-

MiFID II (Europe):

-

Requires LEIs for trade reporting and transparency.

-

EMIR (Europe):

-

Mandates LEIs for derivative contracts.

-

Dodd-Frank (USA):

-

LEIs are needed for swap data reporting.

-

SFTR (Europe):

-

Requires LEIs for securities financing transactions.

Entities failing to obtain or renew their LEIs may face penalties or be unable to trade.

Benefits of Having a Bloomberg LEI

Organizations that obtain a Bloomberg LEI stand to gain numerous benefits beyond just compliance:

. Enhanced Transparency

An LEI enables regulators and partners to clearly identify entities in financial transactions, reducing ambiguity and increasing trust.

. Improved Risk Management

By providing a single source of verified entity data, a Bloomberg LEI helps firms assess counterparty risks more effectively.

. Better Data Quality

LEIs are linked to publicly available data, increasing the integrity and quality of the financial information used in reporting.

. Simplified Reporting

Bloomberg LEI streamlines regulatory reporting, saving time and reducing the likelihood of errors.

. Competitive Advantage

Having a Bloomberg LEI signals to partners and clients that the company values transparency and compliance.

Maintaining and Renewing a Bloomberg LEI

LEIs issued by are valid for one year and must be renewed annually. Failure to renew leads to the LEI becoming “Lapsed,” which may result in compliance issues and transaction restrictions. Bloomberg sends renewal reminders, but it’s the entity’s responsibility to ensure timely updates.

Renewal involves confirming or updating entity information. If there have been structural or legal changes (like mergers or name changes), the entity must provide documentation for validation.

Who Needs a Bloomberg LEI?

LEIs are primarily required by:

-

Corporations engaging in securities trading

-

Banks and financial institutions

-

Asset managers and investment firms

-

Insurance companies

-

Government agencies and nonprofits involved in financial transactions

Even companies not currently under regulatory mandate may choose to register a voluntarily to improve credibility and prepare for future compliance needs.

Bloomberg LEI in the Context of Global Financial Standards

The adoption of LEIs, particularly from globally trusted providers like , is a step toward more stable and transparent global financial systems. The GLEIF’s mission, supported by Bloomberg, is to drive adoption and build a world where each legal entity has a unique, verifiable identity.

With initiatives like the LEI, financial ecosystems can move closer to automation, clarity, and real-time risk assessment—critical factors in the modern digital economy.

Final Thoughts on Bloomberg LEI

The is more than just a regulatory requirement; it’s a cornerstone of identity in financial markets. Whether you are a multinational corporation or a mid-sized investment firm, having a -issued LEI adds trust, improves efficiency, and ensures that your business is future-ready. In a world that increasingly demands transparency and compliance, securing and maintaining a is no longer optional—it’s essential.

Internet Technology

Fintechzoom.com Russell 2000: A Deep Dive into Small

In the dynamic world of financial news and investment insights, fintechzoom.com has emerged as a reliable source for market analysis, with a special focus on key indices like the Russell 2000. As small-cap stocks continue to gain traction among investors, understanding the performance, trends, and strategic value of the Russell 2000 through platforms like fintechzoom.com is more relevant than ever.

This article explores the Fintechzoom.com Russell 2000 connection, examining how the site helps investors understand this vital small-cap index and make more informed decisions in today’s volatile financial climate.

Understanding the Russell 2000 Index

The Russell 2000 index, managed by FTSE Russell, is a benchmark for the performance of 2,000 small-cap companies in the United States. Unlike the S&P 500, which focuses on large-cap stocks, the Russell 2000 provides insight into the undercurrents of the U.S. economy, capturing businesses that often lead innovation and job growth.

Fintechzoom.com Russell 2000 content often highlights how this index reflects broader economic conditions. When small-cap companies do well, it generally indicates confidence in domestic markets and future economic growth.

Why Fintechzoom.com Focuses on Russell 2000

Fintechzoom.com is known for delivering real-time news, in-depth analysis, and financial tools. One area it covers extensively is the Russell 2000, due to the index’s increasing relevance among retail and institutional investors.

Fintechzoom.com Russell 2000 Analysis Tools

Visitors to fintechzoom.com benefit from tools that track Russell 2000 trends, price charts, historical performance, and expert commentary. These tools allow users to monitor how macroeconomic factors such as interest rates, inflation, and political developments impact small-cap stocks.

News Updates and Market Sentiment

The platform provides timely news articles and blog posts that focus on how the Russell 2000 is reacting to economic events. For instance, fintechzoom.com might cover how Federal Reserve interest rate announcements influence small-cap valuations or how earnings season affects the index’s volatility.

The Investment Case for the Russell 2000

One of the primary reasons investors follow the Russell 2000 on fintechzoom.com is to build a strong understanding of small-cap investment opportunities. These companies are typically in growth stages, which can mean higher returns—but also increased risk.

Small-Cap Performance and Volatility

articles frequently stress the importance of diversification when investing in this index. Due to its inherent volatility, even seasoned investors need to stay updated with real-time data, sector-specific developments, and expert opinions—all of which fintechzoom.com provides.

Potential for High Growth

Many of the companies listed in the Russell 2000 operate in emerging industries like biotech, renewable energy, and fintech itself. Fintechzoom.com helps readers identify these growth opportunities through analysis and forecasting features tailored to the

How Fintechzoom.com Adds Value for Investors

Beyond just reporting numbers, curates in-depth content that helps both novice and expert investors make sense of the Russell 2000’s behavior.

Interactive Charts and Real-Time Data

Fintechzoom.com uses interactive charting tools that let users filter data by date, sector, or market cap. This helps investors visualize trends and correlations that are not immediately apparent.

Expert Commentary and Opinion Pieces

Another standout feature of fintechzoom.com Russell 2000 content is its editorial section. Experts weigh in on market conditions, regulatory shifts, and sector-specific growth, giving investors strategic context for their decisions.

The Role of Economic Indicators

To interpret the , fintechzoom.com integrates various economic indicators such as GDP growth, consumer spending, and manufacturing indexes. These indicators help assess how the small-cap market will likely perform in different scenarios.

Case Example: 2025 Market Trends

In 2025, small-cap stocks have shown resilience amid geopolitical tension and inflationary pressure. Fintechzoom.com highlights how the has adapted through sectors like healthcare and green energy leading the charge.

Portfolio Strategies Using Fintechzoom.com Russell 2000 Insights

Investors can utilize insights to adopt smart portfolio strategies tailored to small-cap exposure.

Passive vs. Active Investing

Articles often explore whether passive index tracking or active stock picking is better for exposure. Fintechzoom.com helps readers evaluate their risk appetite, time horizon, and financial goals.

Risk Management Approaches

Fintechzoom.com emphasizes hedging techniques, diversification, and timing strategies based on Russell 2000 volatility. These are particularly helpful for traders looking to minimize drawdowns during turbulent market phases.

Comparing Russell 2000 with Other Indices

Fintechzoom.com often compares the Russell 2000 with broader indices like the S&P 500, Dow Jones Industrial Average, and NASDAQ. These comparisons offer context on market dynamics and relative performance.

Key Insights from Fintechzoom.com Russell 2000 Comparisons

-

Performance Divergence: Often, small-caps in the outperform during early economic recoveries.

-

Sector Breakdown: While S&P 500 is tech-heavy, the has more diversified sectoral exposure, giving fintechzoom.com readers unique angles for diversification.

The Future of Russell 2000 Coverage on Fintechzoom.com

As the investment world leans increasingly on digital platforms for financial intelligence, fintechzoom.com is poised to expand its coverage further. From AI-driven analysis tools to more granular stock insights, users can expect deeper content and personalization.

Emerging Technologies

Fintechzoom.com may soon implement machine learning algorithms that forecast movements, offering predictive analytics based on historical patterns and real-time data.

Enhanced Mobile Experience

With mobile trading on the rise, is also optimizing its dashboards for smartphones and tablets, ensuring investors stay informed anywhere, anytime.

Conclusion

The relationship is a prime example of how digital financial media can empower investors. Whether you’re tracking small-cap trends, developing investment strategies, or analyzing broader economic conditions, fintechzoom.com offers invaluable tools and content to navigate the small-cap landscape effectively.

By providing real-time updates, in-depth analysis, and expert commentary, fintechzoom.com ensures that investors have a comprehensive understanding of the Russell 2000—helping them make smarter, more informed investment choices in 2025 and beyond.

-

Internet Technology9 months ago

Internet Technology9 months agoBest Alternatives to Reddit Soccer Streams for Live Matches

-

Sports9 months ago

Sports9 months agoStreamEast: Free Sports Streaming (Pros & Cons)

-

ART9 months ago

ART9 months agoimagesize:地藏王菩薩 1920×1080 High-Quality Images for Download

-

Blog10 months ago

Blog10 months agoHelonia Neue – The Future of Typography and Modern Design Innovation

-

cryptocurrency10 months ago

cryptocurrency10 months agoCrypto30x.com: A Complete Guide to Crypto Trading and Investment Strategies

-

Internet Technology10 months ago

Internet Technology10 months agoTotallyNDFW: Understanding Its Meaning, Significance, and Impact

-

Health9 months ago

Health9 months agoProstavive Colibrim: Boost Energy & Vitality Naturally

-

Home Decor10 months ago

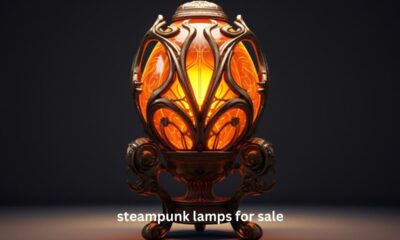

Home Decor10 months agosteampunk lamps for sale at luzdeco.es